Accounting Integrations Troubleshooting

Below is a list of common errors encountered with Xero and MYOB integrations, what they mean, and how to resolve them.

Xero

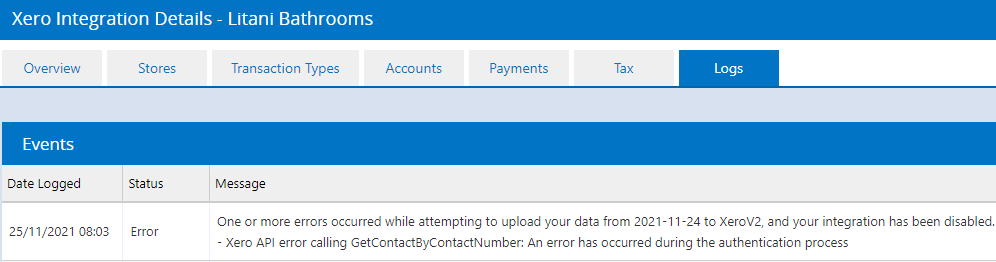

API Error - Enabled

Error:

- Xero API error calling GetAccounts: An error has occurred during the authentication process

- Xero API error calling GetContactByContactNumber: An error has occurred during the authentication process

Solution:

- Go to Settings > Integrations > Xero

- Click the blue pencil (edit) icon

- Set Status to Enabled

- Click Save All

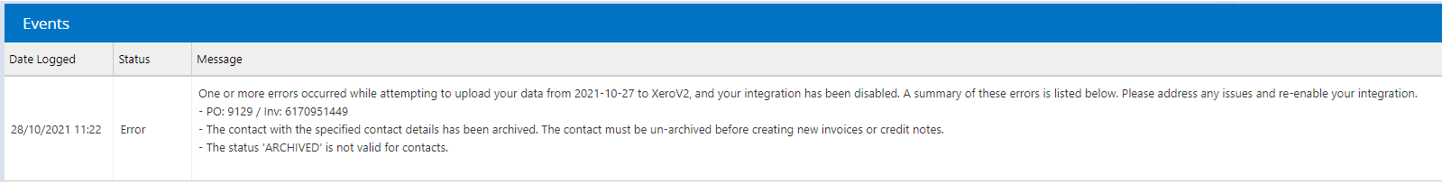

Archived Contact

Error:

- The contact with the specified contact details has been archived. The contact must be un-archived before creating new invoices or credit notes

- The status 'ARCHIVED' is not valid for contacts

Solution: Un-archive the affected contact in Xero, then re-enable the integration.

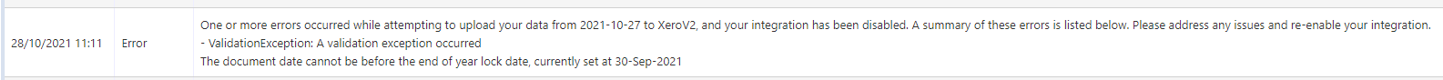

Locked Period

Error:

- ValidationException: The document date cannot be before the end of year lock date, currently set at [Lock Date]

Solution:

- In Retail Express, go to Reports > Accounting Reports > Income Report

- Apply filters around the failed date to identify the transaction

- Unlock the lock period in Xero

- Re-enable the integration

- Once data has synced, re-lock the period

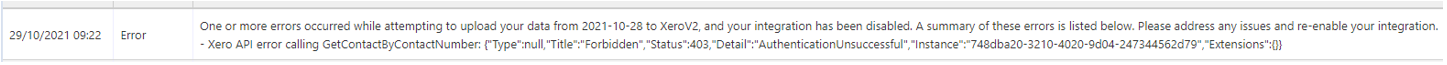

Reconnect

Error:

- Xero API error calling GetContactByContactNumber: AuthenticationUnsuccessful

Solution:

Reconnect your Xero account through the integration settings.

Payments

Error:

- Errors referencing payment types (EFTPOS, Cash, Mastercard, etc.)

- Example: "An error occurred in Xero. Check the API Status page..."

Solution:

Remove the affected payment(s) from the invoice(s) in Xero, then re-enable the integration. Each payment line must be removed individually.

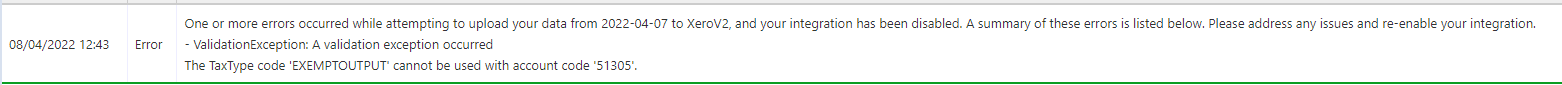

Tax Code

Error:

- ValidationException: The TaxType code 'EXEMPTOUTPUT' cannot be used with account code '51305'

Solution:

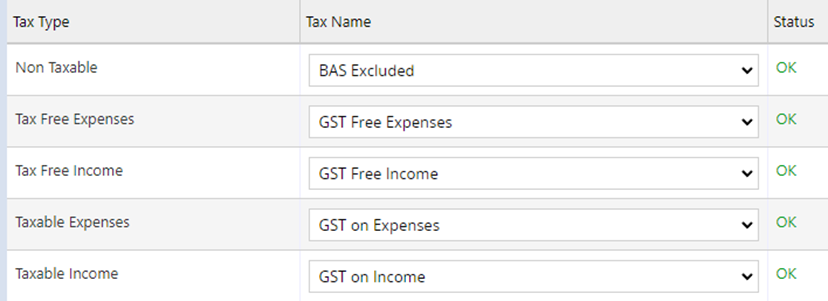

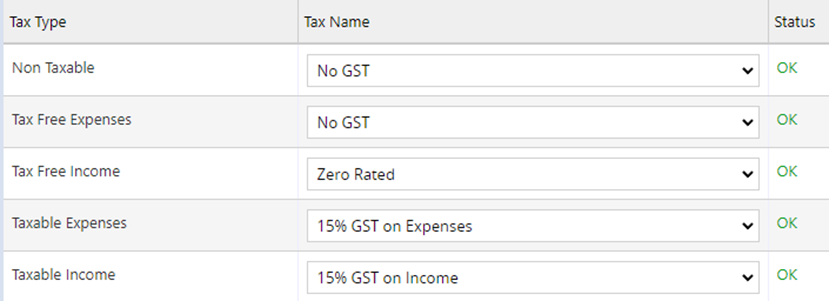

Update the tax code in Xero to the correct one for your region.

- Australia

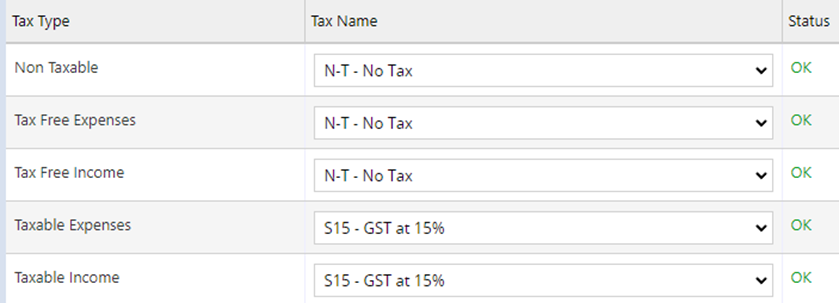

- New Zealand

![Screenshot Placeholder]

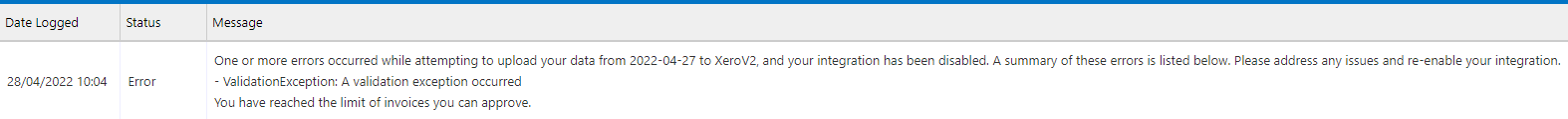

Reached Invoice Limit

Error:

- ValidationException: You have reached the limit of invoices you can approve

Cause & Solution:

- This often occurs with the Xero Starter plan, which limits users to 20 approved invoices per month.

- Confirm your Xero subscription and upgrade if required.

- Check if other integrations are also contributing to invoice usage.

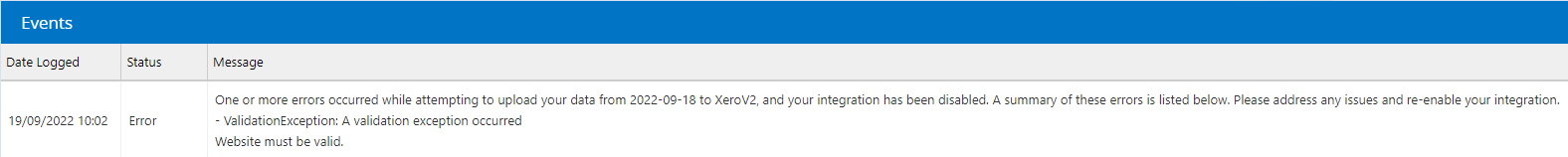

Website Address

Error:

- ValidationException: Website must be valid

Solution:

Remove the website address field from the supplier contact(s) in Xero.

- Run Reports > Accounting Reports > Purchase Order Report for the failed date

- Remove website addresses from the supplier contacts listed

MYOB

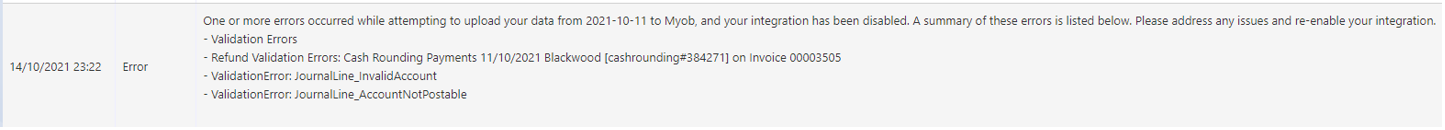

Linked Accounts

Error:

- ValidationError: JournalLine_InvalidAccount

- ValidationError: JournalLine_AccountNotPostable

Solution:

Review your MYOB linked accounts settings and update as required.

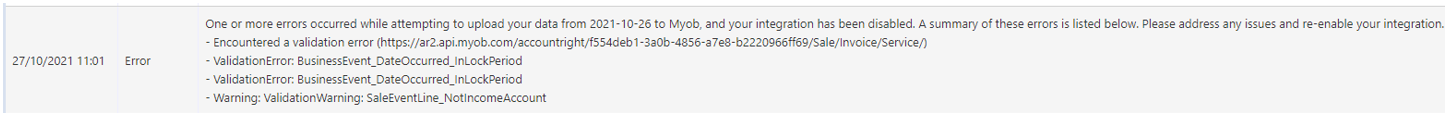

Locked Period

Error:

- ValidationError: BusinessEvent_DateOccurred_InLockPeriod

Solution:

- Use Reports > Accounting Reports > Income Report to find the problematic transaction

- Unlock the lock period in MYOB

- Re-enable the integration

- Re-lock once data syncs

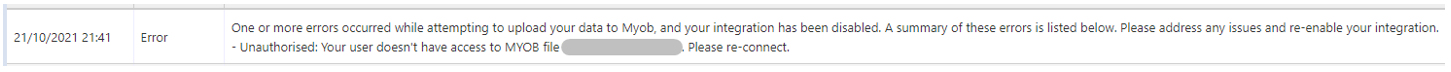

Reconnect

Error:

- Unauthorised: Your user doesn't have access to MYOB file. Please re-connect

Solution:

Reconnect your MYOB account through the integration settings.

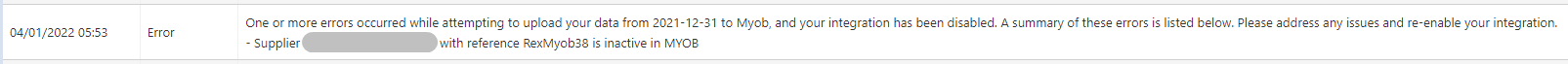

Inactive Supplier

Error:

- Supplier [Name] is inactive in MYOB

Solution:

In MYOB, activate the supplier card, then re-enable the integration in Retail Express.

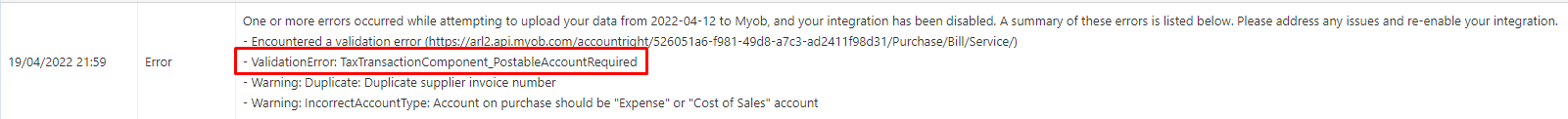

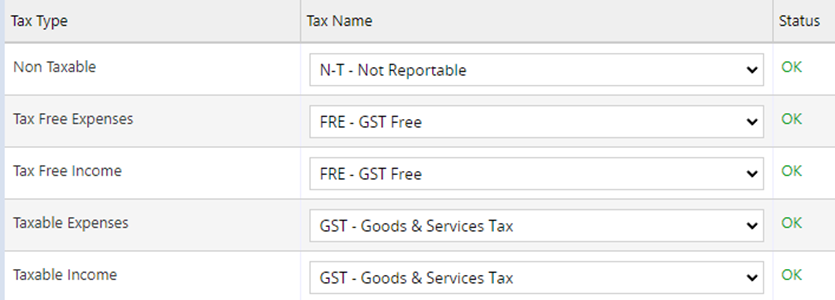

Tax Codes

Error:

- ValidationError: TaxTransactionComponent_PostableAccountRequired

Solution:

In MYOB, go to Lists > Tax Codes and confirm each tax type has a correctly configured GL account.

- Australia

- New Zealand