You can efficiently handle pre-payment account customer refunds through processing refunds for sales in Awaiting Payment status in Retail Express, which enables canceling unfulfilled account orders before payment collection. This refund workflow helps retail operators manage account customer changes and cancellations cleanly, with effective awaiting payment refunds typically maintaining accurate account customer records and supporting flexible customer service across Australian retail operations.

Awaiting Payment refund functionality in Retail Express enables retail operators to cancel account customer orders before payment processing, helping ensure accurate customer account balances and clean transaction records. This refund capability helps ensure your retail operations can efficiently handle order cancellations while maintaining accurate account customer records and supporting positive customer relationships.

If you need to refund a sale that has not yet been paid but the stock has been fulfilled/provided to the customer, you'll be able to perform a refund to return the stock.

Creating a Refund

- Log into POS

- Click Returns

- Enter your User ID

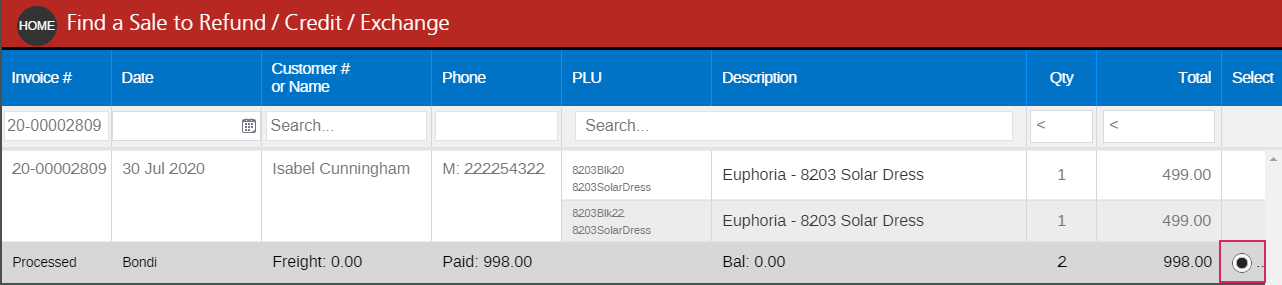

- Find the sale to be refunded by entering the Original Sales Order/Invoice Number or using the filters

- Click the radio button in the Select column to select the sale

- Click Next

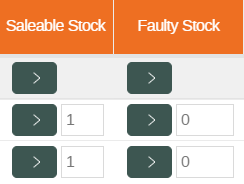

- Enter the quantity to be returned in either the Saleable or Faulty columns (this will update the Inventory for either the Available or Faulty stock buckets)

- Select the Outlet where the stock is being refunded to

- Click Next

- Adjust the Refund Amount if required

- Click Next

- Select a Return Reason

- Click Create Refund

- The Refund/Exchange transaction will be created and ready to action

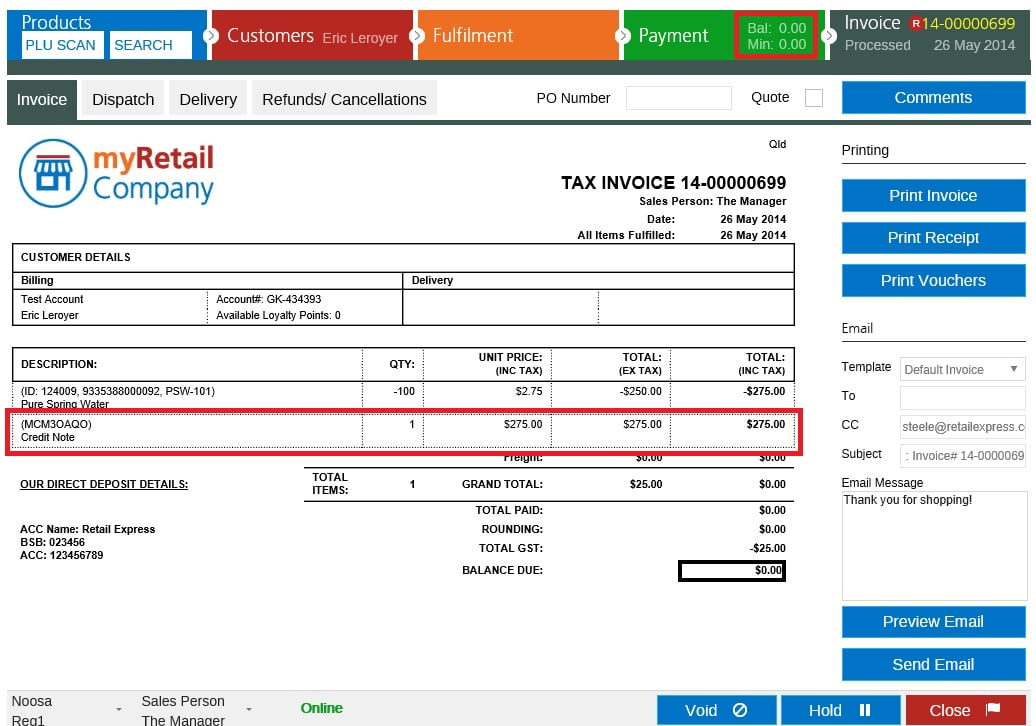

- The Order Total will be negative

- As the customer never paid for the original sale the system will apply a credit back onto the customer?s account

- Click Close to close the sale and return to the main screen of POS.

Back to top

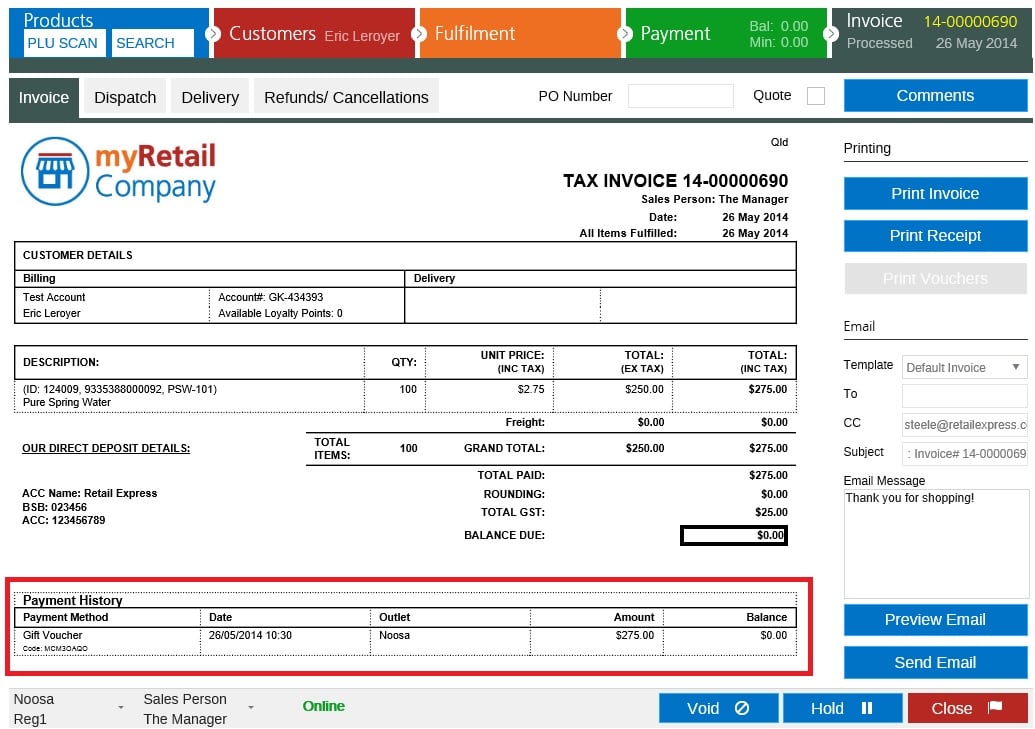

Viewing the Credit Note

As this transaction had a balance outstanding the credit note will be automatically applied to the sale. The Credit note can be seen on the tax invoice, as well as the products tab, and the payment history.

Products tab

Payment History

Back to top

Related Articles

Point of Sale Operations: